closed end loan disclosures

10 March 9 2022. Calculation of amount financed APR finance charge security interest charges.

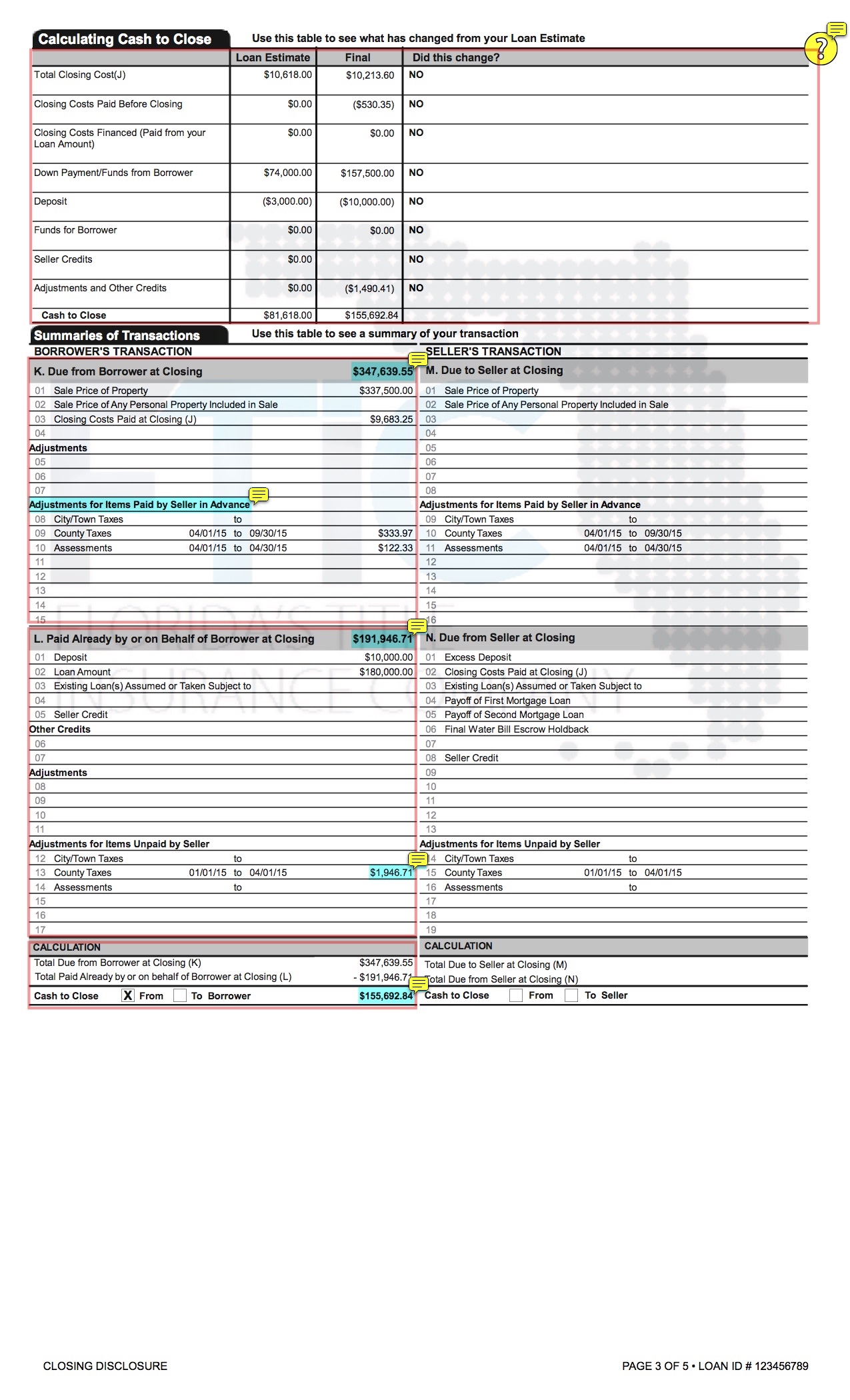

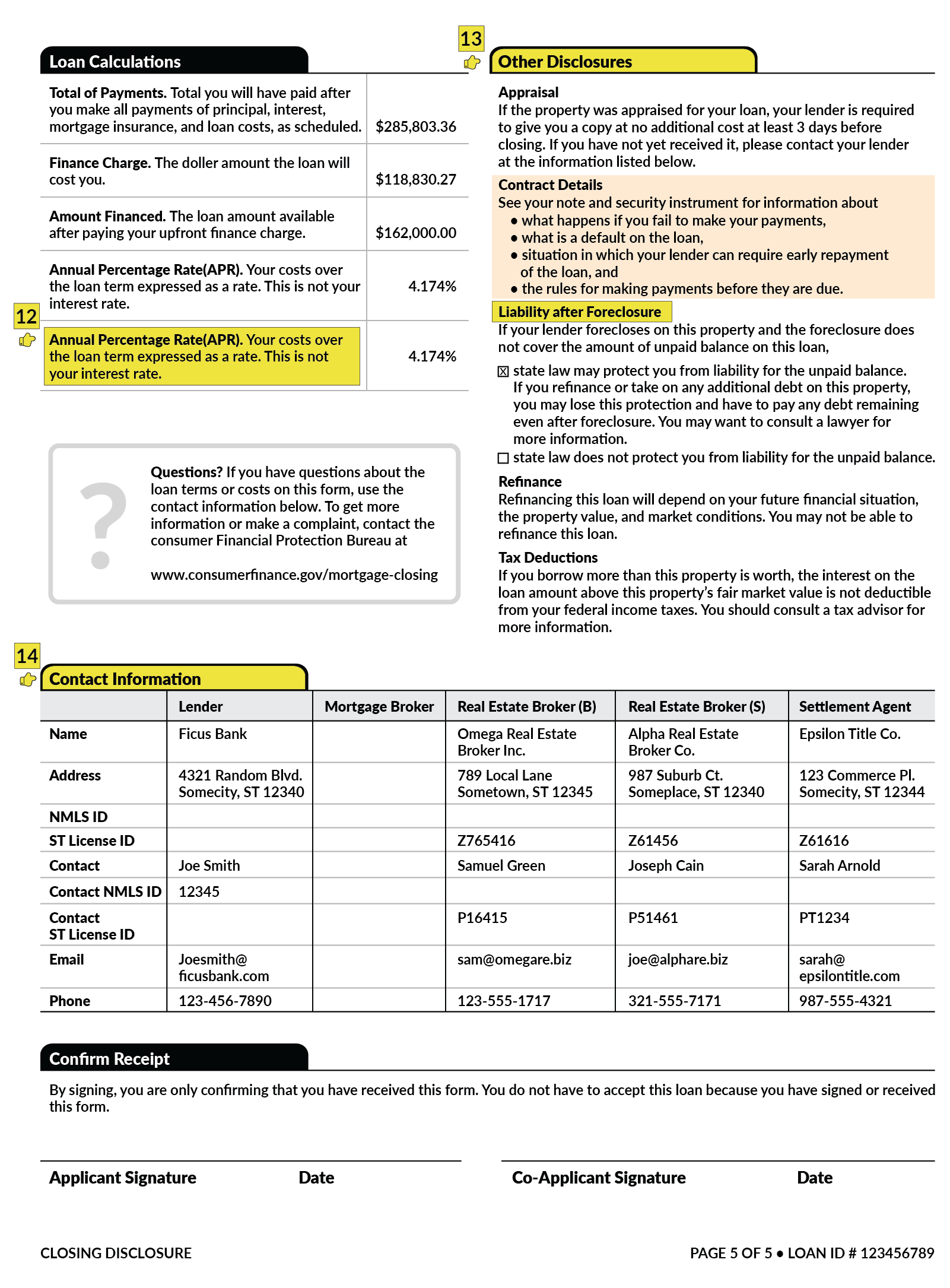

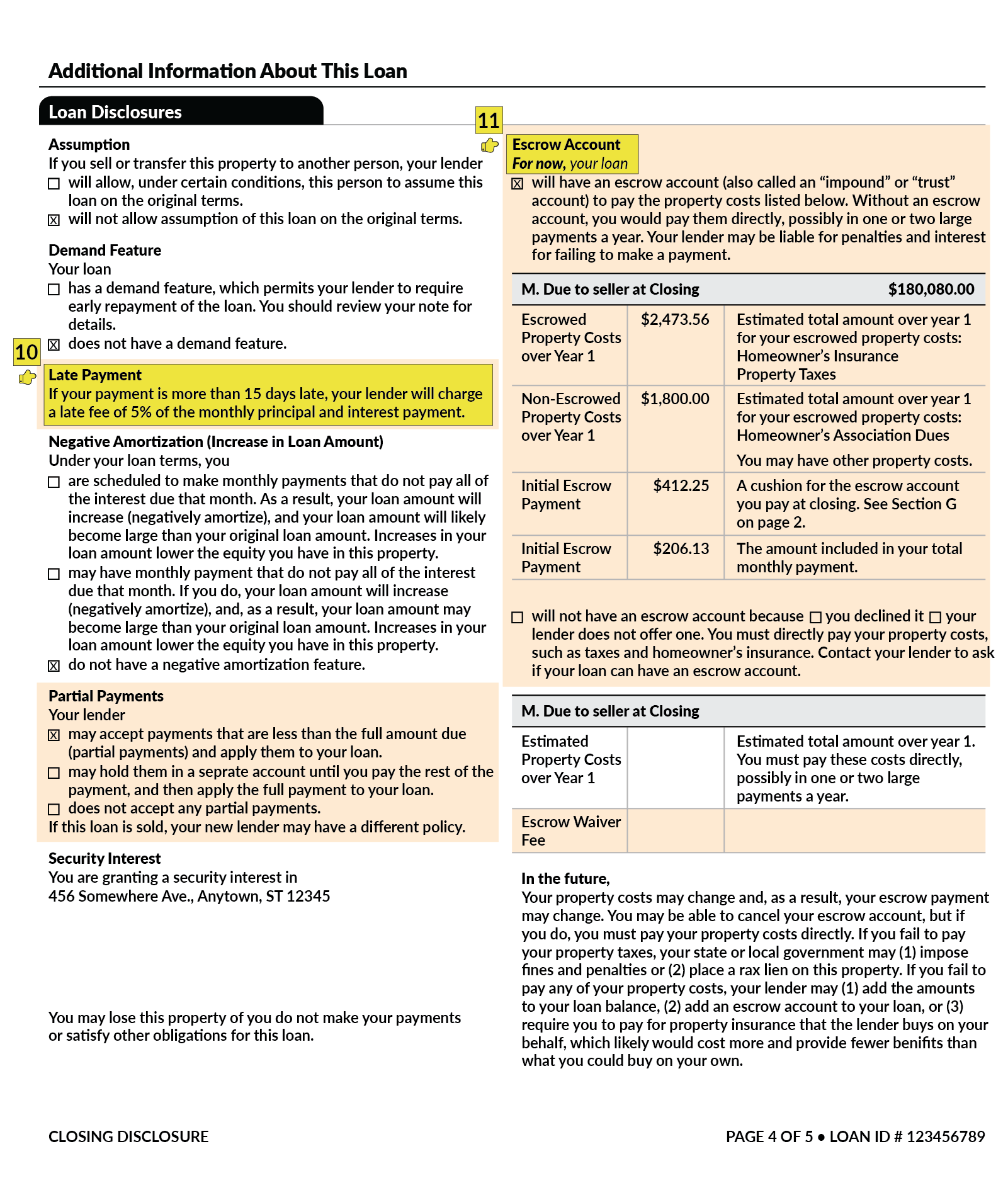

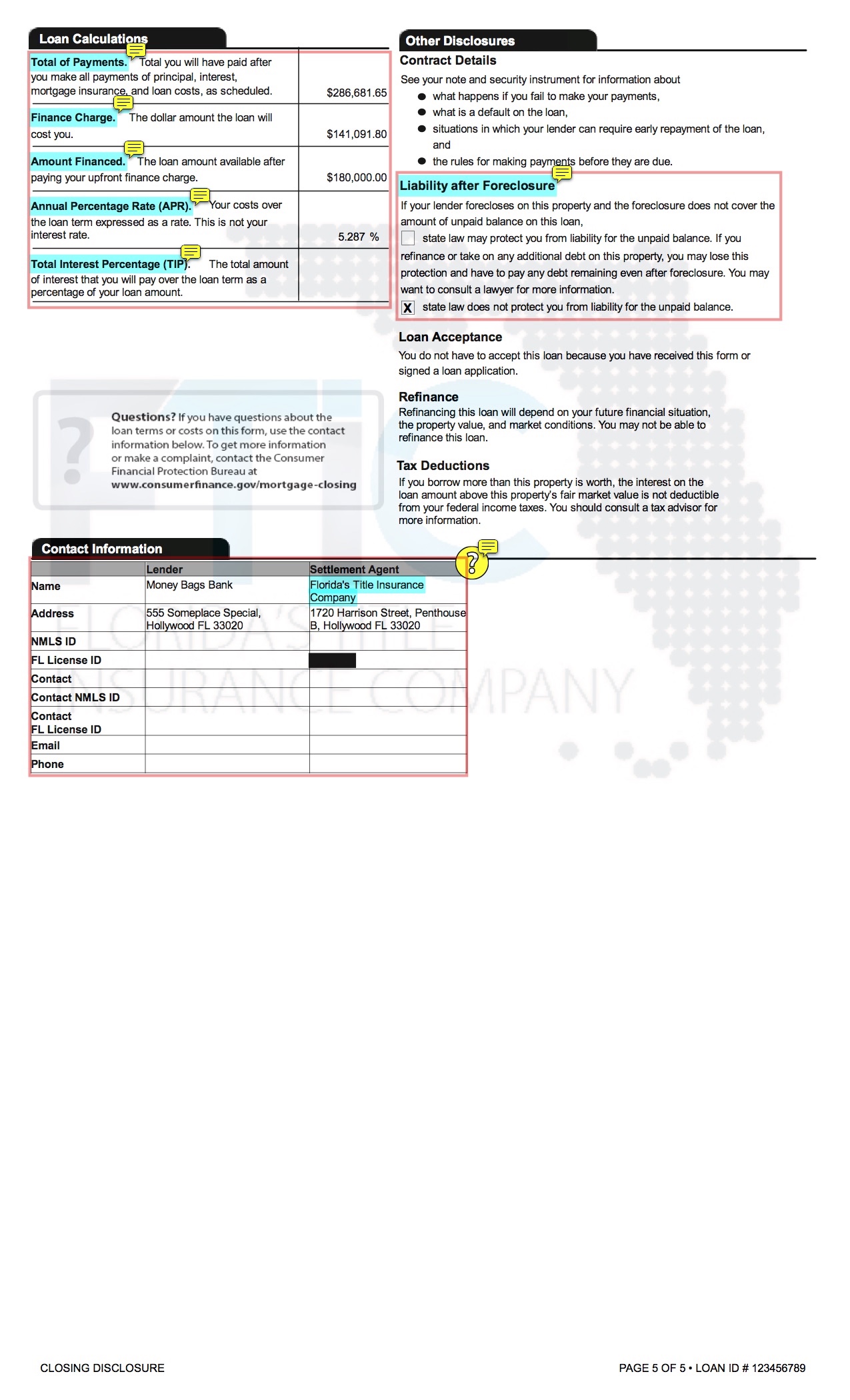

Closing Disclosure Form Fill Online Printable Fillable Blank Pdffiller

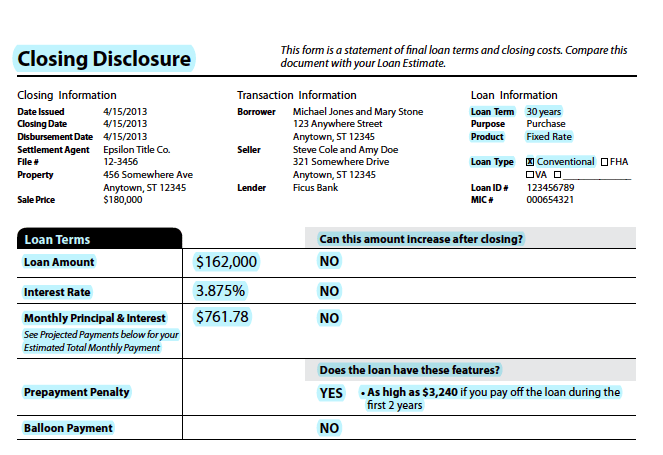

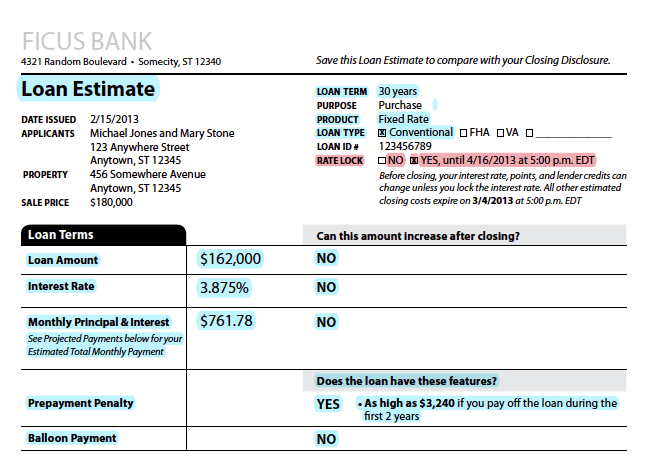

The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit.

. Of the disclosures you list here would be the status in a closed-end home equity loan. 2 The number of payments or period of repayment. -END NOTE DISCLOSURE BORROWERS NAME AND ADDRESS.

All disclosures required under this Part are to be made in a single separate document in plain language and with captioned subdivisions for the information to be disclosed. The Loan Estimate must be in. Current through Register Vol.

Section 332 - Disclosures. Please print review sign and return this Loan Disclosure Agreement with your Consumer Loan Application. Unfortunately noif during the loan term a HELOC is converted from open-end credit to closed-end credit that would trigger closed-end credit requirements including the TRID disclosures as set out here.

Format of Regulation Z. Requires certain disclosures be made to the member before consummation of a closed-end home equity loan. For closed-end credit transactions secured by real property Reg Z 102619 requires Credit Unions to provide members with good-faith estimates of credit costs and transaction terms on a document called the Loan Estimate.

The Loan Estimate is provided within three business days from application and the Closing Disclosure is provided to consumers three business days before loan consummation. Mortgage Loans are limited to primary residences located in Erie and Crawford Counties in Pennsylvania. Regulation Z Closed End Disclosure Content for Mortgage Loans.

Short term financing secured by existing home and new home. 123 Any Street CLOSED City State 12345 LOAN AND SECURITY AGREEMENT 800 123-4567. Description of the security interest if applicable.

Stating No downpayment does not trigger additional disclosures. This requirement is only applicable to first. Bridge loans are exempt from RESPA and HMDA reporting however they are still subject to the applicable Reg Z provisions including the right to cancel.

Or 4 The amount of any finance charge. O A fully completed closed end second mortgage loan application signed by the loan applicant and the loan originator. I decline the conditions as listed above.

Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie. When the existing home is sold the short term loan will be paid in full. Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling.

Such disclosures shall be provided by the lending institution to the person who is to be primarily liable on the. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures. A refinancing takes place when an existing obligation is satisfied and replaced by a new obligation for the same borrower.

When you apply for a mortgage loan the lender is required to provide you with initial loan disclosures within three days of application. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form. CO-BORROWERS DATE OF BIRTH.

Loan Originator must submit the first and closed end second mortgage simultaneously to FLCB and utilize the Combo First and Second Loan Submission checklist The following formsdisclosures are required. 1 The amount or percentage of any downpayment. Higher-cost closed-end mortgage loans and included new disclosure requirements for reverse mortgage transactions.

Not a bridge loan. 2nd Mortgage Fixed Rate Closed End Loan Disclosure. I accept the conditions as listed above.

The Credit Union will provide closed-end disclosures that will include the following information. 2801 VIA FORTUNA SUITE 600 AUSTIN TX 78746 Page 1 of 2800 569-3665 WWWSMSLPCOM. Regulation Z Closed End Disclosure Content for Mortgage Loans.

For a closed-end transaction secured by real property or a dwelling other than a transaction that is subject to 102619e and the creditor shall disclose a statement that there is no guarantee the consumer can refinance the transaction to. Converting open-end to closed-end credit. Thus for most closed-end mortgages including construction-only loans and loans secured by vacant land or by 25 or more acres not covered by RESPA the credit union must provide the.

Except for home equity plans subject to 102640 in which the agreement provides for a. 3 The amount of any payment. Payment schedule including number amount and timing of payments.

Only applies to purchase-money loans subject to RESPA. Depends on lien position. Requirements under the TILA-RESPA Integrated Disclosure rule TRID.

Generally the only time that new Truth in Lending Act TILA disclosures are required for closed-end loans is if a refinancing occurs. The regulation was also revised to reflect the 1995 Truth in Lending amendments that dealt primarily with tolerances for loans secured by real estate and limitations on lenders liability for disclosure errors for these types of loans. Trigger terms when advertising a closed-end loan include.

The Federal Reserve has published several rules implementing certain provisions of the Mortgage Disclosure Improvement Act MDIA. You are requesting an application for a Second Mortgage closed-end fixed rate loan. These disclosures must be used for mortgage loans for which the creditor or mortgage broker receives an application on or after August 1 2015.

Click hereto complete and print your Loan Application. LOAN MATURITY DATE LOAN OFFICER LOAN NUMBER BORROWERS ACCOUNT NUMBER CO-BORROWERS NAME AND ADDRESS. Mortgages and Initial Disclosure Rules.

BORROWERS DATE OF BIRTH. You and Your mean each and all of the applicants signing on the reverse You certify the accuracy of the information given in this application and you will notify the Credit Union in writing immediately if there is any.

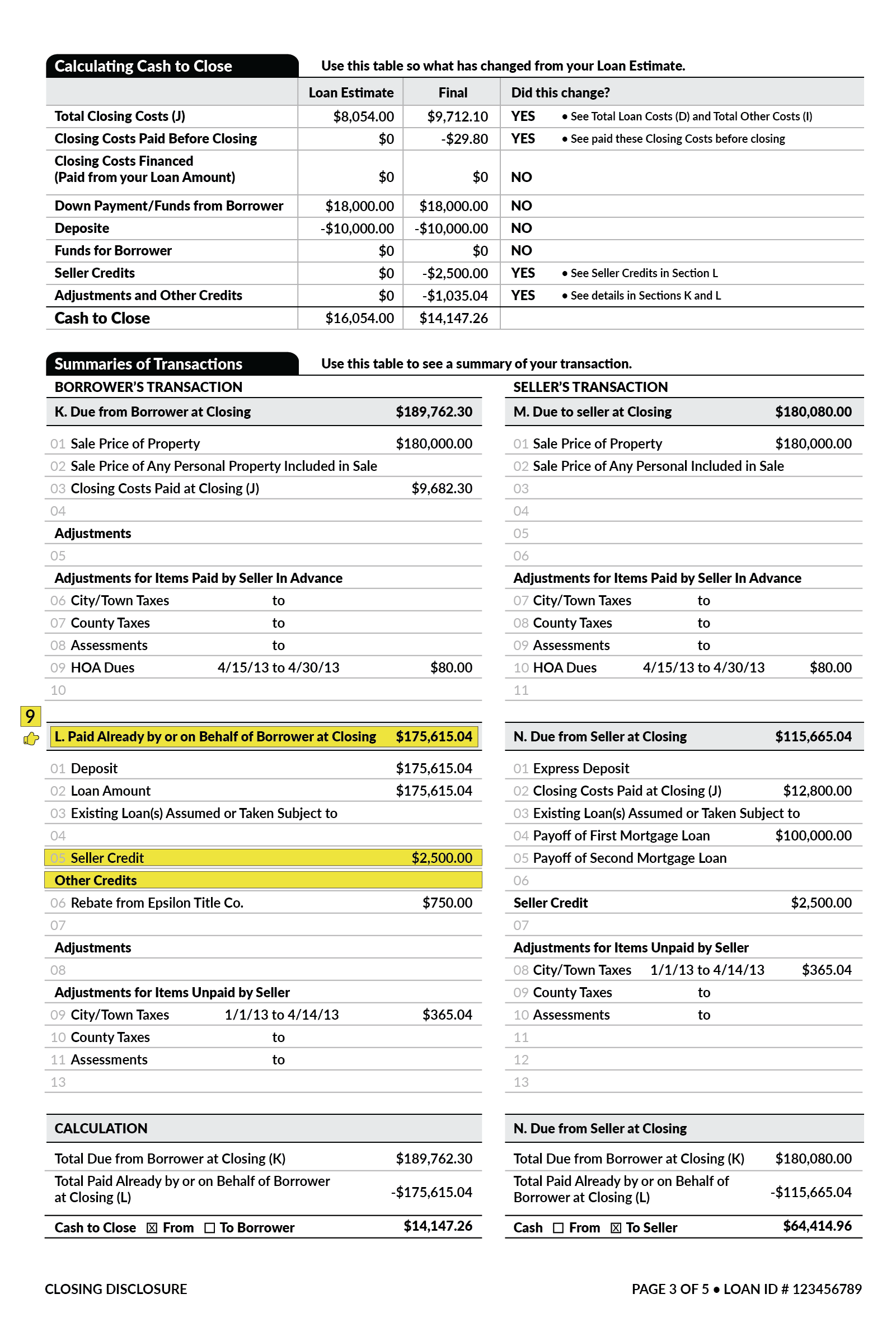

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

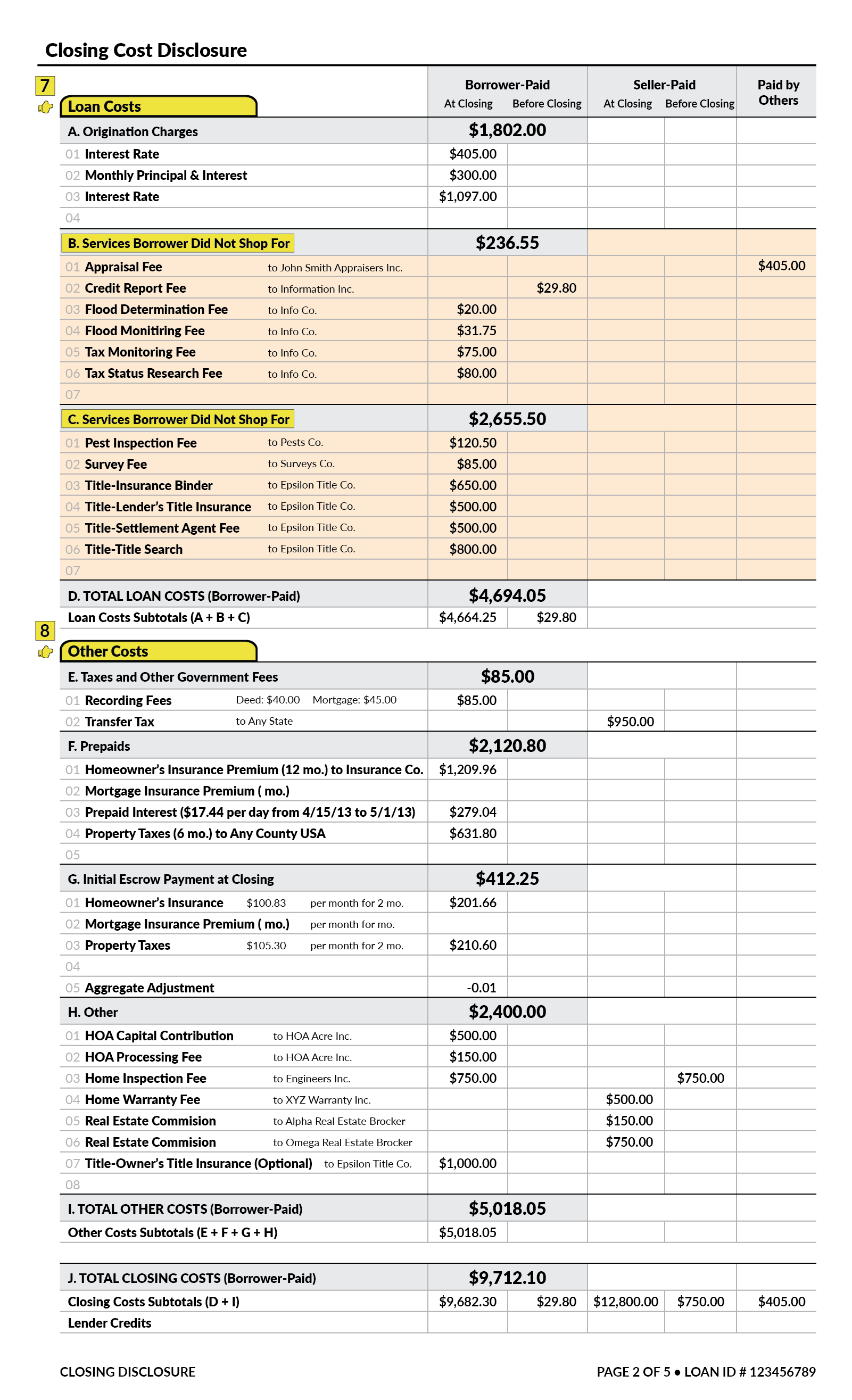

What Is A Closing Disclosure Lendingtree

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How The Trid Closing Disclosure Delivery Period Works Myticor

What To Know About The Loan Estimate Closing Disclosure Cd

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

What Is A Closing Disclosure Lendingtree

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What Is A Closing Disclosure Lendingtree

Fillable Form Closing Disclosure Edit Sign Download In Pdf Pdfrun

What Is A Closing Disclosure Lendingtree

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What To Know About The Loan Estimate Closing Disclosure Cd

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau

Understanding Finance Charges For Closed End Credit